How The Charlie's Angels Effect Makes You Poorer, Sicker & Maybe Uglier

by Brian W. Vaszily for www.SixWise.com

|

About About

Brian Vaszily

Brian Vaszily (pronounced "vay zlee")

is a bestselling author, positive change advocate, speaker/organizer and

sometimes funny guy whose life mission is to help others explore, experience

and enjoy life more intensely while bypassing the traps that would hamper

that goal -- particularly unscrupulous marketing and rampant consumerism.

Brian is the founder of IntenseExperiences.com,

has authored several books including the acclaimed novella Beyond

Stone and Steel (see Very-Clever.com

for some reviews), and with over fourteen years of marketing management

experience is President of the TopMarketingPro consultancy.

In addition to his How

We Get You columns here at SixWise, Brian also leads the popular Sixwise.com

blog, "The

'Live Deeper' Blog by Brian Vaszily." He has appeared on many

TV and radio shows and been quoted in many publications regarding his

books, columns, articles and ideas. Brian Vaszily was born and raised

in Chicago, growing up on the northwest side in the blue-collar Portage-Cragin

neighborhood. Brian and his wife and two children currently reside outside

Chicago, Illinois.

|

Before we get to Charlie's Angels, four key facts for you about debt:

-

"Good" debt is not nearly as bad as "bad" debt, but it's probably worse than you think. Good debt is money you owe on stuff that will likely be worth more over time than what you owe on it, such as a house or that handkerchief that belonged to Elvis you invested in. Problem is, due to stealth marketing scams such as "The Charlie's Angles Effect," you probably paid more for these investments than you should have.

-

Bad debt -- which is now more American than apple pie or obesity -- is really bad. It is money you owe on stuff that doesn't contribute to your growth, except perhaps your waistline's. It is most commonly found on little squares called "credit cards." In the U.S., the average adult carries about $8500 in credit card debt. Over 60% of active credit card accounts are not paid off monthly. The average interest rate on credit cards is 18.9%.

-

Being in debt is one of the most critical health issues of our time. It is the leading cause of stress, and stress is a leading cause of chronic disease (and a leading cause of violence). Being in debt, particularly bad debt, is contributing to reduced length and quality of life.

-

Being in debt, especially bad debt but even the not-nearly-as-good-as-it-could-have-been good debt, sucks

As some of you know, I am a marketer, and have been for over fourteen years. I used to be on the Dark Side of marketing, where the most sophisticated, fascinating and despicable tricks are constantly unleashed on an unaware public to get evermore of their money - at great expense to their health and happiness.

Since recognizing that this unethical marketing is far and away the most devastating health and wellness epidemic of our time (it is the core cause of the obesity crisis, the anxiety crisis, and the debt crisis, to name but a few), my mission has been to expose all the dirty tricks the marketers use to con you into the beliefs, habits and purchases that are destroying your pocketbook, peace of mind, and health.

And that brings us to one of the most powerful such tricks of all, and the Charlie's Angels.

If You're Considering a Big Purchase,

Watch Out for the Charlie's Angels ... Effect

Truth is, the thousands of little impulsive purchases people make cause bad debt, because the small cost here and the small cost there (and there, and there, and there) all seem so insignificant ... until they are added up over time.

As logic goes, the big purchases can cause debt much more quickly -- and more apparently -- and so people are typically far more cautious about making them. But because they are big purchases, they're also much more excited about them.

Marketers (who come in many titles such as Salesperson, Realtor, or Timeshare Tour Guide) know all this. And over time they have perfected what I call the "Charlie's Angels Effect" to take full advantage of it ... and you.

Back in 1980, the Journal of Personality and Social Psychology published the results of an experiment by Douglas Kenrick and Sara Gutierres that had males rate how attractive a potential date was before watching the television show "Charlie's Angels" versus how attractive a potential date was after watching the show. The men resoundingly rated potential dates as less attractive after watching the famous show than before.

What has this got to do with marketers conning you with big purchases?

Everything.

The most important word to remember from this entire column -- after "Vaszily" of course -- is "context." Depending on the context something is presented in, stuff of any sort can be made to look much better or much worse without the recipient of the presentation even realizing it.

In the experiment above, Farrah Fawcett and the other Charlie's Angels super-goddesses (I loved them in the 1970s, and I think they loved me, so forgive my enthusiasm) were used to decrease the attractiveness value of those poor potential dates. But Granny from The Beverley Hillbillies could just have easily been used to increase their perceived attractiveness.

In the experiment above, Farrah Fawcett and the other Charlie's Angels super-goddesses (I loved them in the 1970s, and I think they loved me, so forgive my enthusiasm) were used to decrease the attractiveness value of those poor potential dates. But Granny from The Beverley Hillbillies could just have easily been used to increase their perceived attractiveness.

And so you need to ...

Learn to Spot the Refrigerator Decoy on the Appliance Store Floor

One of the most powerful examples of "The Charlie's Angels Effect" is in real estate. So here's a little story for you:

After hearing the essentials on what you are looking for in a house, your real estate agent drives you out to see a couple of houses that "may interest you."

The first -- right there in your price range -- seems to resemble the shape of a house, but aside from that the windows constantly rattle from the interstate running through the backyard, the carpeting still holds stains from pets that have long since met their Maker, and it doesn't appear to have been painted since Medieval times.

After making you a bit nauseous with this so-called house, the real estate agent THEN drives you to a lovely home (that is, it is clean and neat) that is "just a few thousand dollars" above your desired price ... and you are hooked.

It is all about context -- and marketers like this real estate agent are trained to manipulate your perceptions with that fact in mind.

(Beware too that I have simplified the process in the real estate example above -- they can get very sophisticated to get you to spend far more than you intended to, such as using many decoys at many different levels versus just one.)

Any retailer that sells higher-cost items is well aware of "The Charlie's Angel Effect" (though they don't call it that ... behind the scenes they laugh and call it "suckering the customer" or similar designations). And in their stores and showrooms they even intentionally place decoys to take advantage of you with the effect.

In many appliance stores, for example, there are decoy new refrigerators, decoy new ovens, decoy new washers and dryers, etc. that are essentially the worst values on the floor (the fewest features, shortest warranty, etc.). Pricing is studied carefully, of course, so these decoys are priced at the level most people have stated they can afford. So Mr. Caring Salesperson shows you this model right in your price range, discusses the limited features in a graveyard voice, then springs to life because "for just a hundred dollars more you can have the vastly superior model over here ... "

You get the picture.

And the picture is the same at many of the new and used auto dealerships, furniture stores, computer and electronics stores, jewelry shops, and other retailers that sell pricey stuff.

Scald Them with Your Amazing Knowledge

So what can you do to avoid getting robbed by "The Charlie's Angels Effect"? This time the answer is simple: do your homework.

|

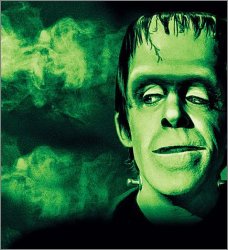

How to practice staying aware of "The Charlie's Angels Effect": Look at a significant man in your life. Rate his looks. Now look at this picture of Herman Munster, then look at the significant man in your life and rate his looks again. Did he rate higher the 2nd time? That's the effect at work! |

Study and compare your potential purchase in Consumer Reports, see what other customers have said about the costly product or service at sites like Amazon, and study the market to know what your hard-earned money should be getting you.

Assuming your knowledge is a temperature, never ever go in cold or even lukewarm to any salesperson, real estate agent, marketer or anyone who wants to sell you pricey stuff -- some are ethical, but unfortunately many others are not and will want to eat you. Go in hot, knowing exactly what you can really get for your money based on your homework. Tell them upfront that you have this knowledge, you know all about "The Charlie's Angels Effect," you have no desire to see any decoys, and if you do (say it sweetly now) they will lose the sale.

They'll get the picture.

And finally, if you are a male reading this and you have a wife, a girlfriend, or a potential date, do her and yourself a favor and watch reruns of The Munsters instead of Charlie's Angels. In fact, have her watch it with you -- it's all about context, and Herman Munster can make any man look like Brad Pitt by comparison.

|

Some Previous Columns by Brian Vaszily

(Compare to the National Enquirer ... You'll See These are MUCH Better)

If You Do Not Read this Column, Something VERY

Bad Will Happen: Unethical Marketing 101

Check Out All the Violence Here! or How I Jolt

You into Submission to Get Your Money

Rebate Scams: How I Deceive the Heck

Out of You with Consumer Rebates |

572